SG Eco makes customized Sky Tunnels with 3 x Ventilation Outlets for New Zealand. This unique system allows just one roof flashing for 4 separate items. Venting from 3 x separate rooms, and then also includes a 343mm Sky Tunnel Roof Parts into this single flashing.

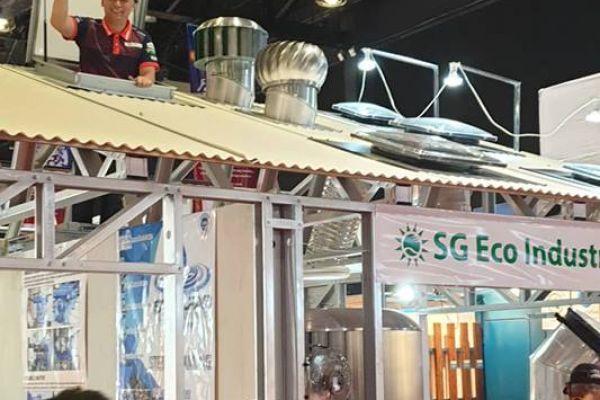

Worldbex 2019 had it's largest participation in the 24 years the exhibition has been running.

It was our 11th time exhibiting at Worldbex, the 9th time we have as SG Eco Industries.

Once again it was a great success, with plenty of opportunities arising from the exhibition. Our display was a little different this year, as our booth was constructed with a steel frame housing structure. This allowed us to do actual installations of our products.

We will be back exhibiting next year at Worldbex 2020. We hope to see you there!

The UK economy saved nearly £250m in fuel costs last year by generating its energy more efficiently, Government figures show.

This saving is equivalent to the gas bills of more than 350,000 homes.

The Digest of UK Energy Statistics, published annually by DECC, reported an increase in combined heat and power plants, with 54 new schemes built in 2014.

However, some industrial sectors saw limited new investment and some key industrial sectors saw significant reductions in CHP capacity and generation.

ADE director Dr Tim Rotheray said: “There are hundreds more commercial and industrial sites that could benefit from generating their own heat and power locally by putting the right policy framework in place.

“A welcome tax relief implemented in 2015 is key to protecting existing industrial efficiency investments. The Government’s forthcoming Carbon Taxation review now presents a major opportunity to unlock the untapped efficiency opportunity, boost energy productivity and support UK business competitiveness.”

(Article first published on: theguardian.com | May 5, 2015 by Katie Forster)

Just further evidence of how solar lamps have helped improve the health of one community’s people, save on expensive and harmful fuel whilst reducing carbon emissions at the same time. To find out how you can access leading edge solar powered lighting technology for yourself or your business check out our site at http://www.eco.ph/

In Kenya, where less than a quarter of the 45-million population has access to electricity, a solar lamp project is helping rural communities save money on expensive and harmful fuel while reducing carbon emissions. The Use Solar, Save Lives initiative was set up in 2004 by Evans Wadongo, 29, an engineer who experienced the dangerous effects of kerosene lamps growing up in a western Kenyan village. Studying close to an open flame, he was exposed to kerosene smoke, notorious for provoking breathing and vision defects, which left him with permanent eye problems.

Determined to make a difference, Wadongo designed an alternative – a simple, sun-powered lantern dubbed a MwangaBora, which means “good light” in Swahili. The lamp is cleaner and greener, and also cuts costs. “For a family that earns two dollars a day, kerosene takes about 30-40% of their daily income. If they’re able to save that, it really makes a big difference,” says Wadongo. The lamps are made from locally sourced scrap metal and fragments of solar panels that charge a battery-powered LED light, while a USB port can be built into the base, offering an easy way to charge phones and radios.

Instead of importing solar technology from a mass producing country such as China, groups of young people are trained to manufacture the lamps. These are then given to women’s groups, who use the money they save to set up small businesses such as poultry farming or beekeeping. “When women have their own income, they spend it on their families and the whole community benefits,” says Wadongo. Winning an international Seed award in 2011 helped the organisation to circulate lamps around the country – there are now more than 50,000 MwangaBora used in Kenya alone. Fundraising exhibitions featuring the lamps have taken place in New York and at thePavilion of Art and Design in London, and Wadongo was named as one of CNN’s top 10 heroes in 2010. At the 2012 London Olympics, he was selected as one of four torchbearers for Kenya.

Despite these accolades, and donations from around the world, Wadongo says that financing the project is a challenge due to its long-term nature. Each lamp costs $25, which covers materials, training and distribution. The women’s groups can use money from their successful businesses to buy more lamps, creating a micro-finance system. “We want to make sure that in every community we get into, we leave them not only with lamps but with increased income levels,” he says.

The project has already taken off in Uganda and Wadongo is looking to further expansion. “We still have a whole lot of work to do in Kenya. By 2018, we want to be working in at least five countries in sub-Saharan Africa and have a million people benefiting from our program. Eventually we want to be able to do the same in South America, for example.”

And the impact could be global. Solar power saves lives by reducing the risk of fire caused by open flames and by improving villagers’ economic and educational prospects, but also by helping to save the planet, says Wadongo. “Burning one litre of kerosene produces 2.6kg of CO2, so with more than a billion people worldwide using it every day, you can imagine how much is emitted into the environment.”

(Article First Published on: dailymail.co.uk | April 21, 2015)

- Demand is being fuelled by solar panels provided through 'rent-a-roof'

- Companies offer free installation in return for pocketing surplus energy pay

- Market researchers say demand for solar panels has exploded since 2010

Rising energy bills are driving more homeowners into installing solar panels on their roofs. And experts say there is still ‘strong growth potential’, with three fifths of householders said to be considering the option. Demand is being fuelled by solar panels provided through ‘rent-a-roof’ schemes, whereby companies install the system free in return for pocketing payments for the surplus energy that is fed into the National Grid.

Soar in demand: Rising energy bills are driving more homeowners into installing solar panels on their roofs. Demand is being fuelled by 'rent-a-roof' schemes and the Government's Green Deal finance initiative.

However, a quarter of respondents to a survey by market researchers Mintel would either buy the panels themselves to get the feed-in tariff or use the Government’s Green Deal finance scheme.

Claudia Preedy, a Mintel analyst, said: ‘Although the market remains in its infancy, demand for solar panels has exploded since 2010 and there continues to be strong growth potential.

'The market was originally driven by residential roof-top installations, reflecting the introduction of the FIT scheme in April 2010.

'However, in 2013 and particularly during 2014, there was a shift in focus from roof-top to large-scale ground mounted installations.

'These policy changes reflect the current government's desire to see a shift in solar developments from large scale ground-mounted towards mid-scale building-mounted, commercial and industrial onsite generation and domestic deployment.'

Of the homeowners who have solar panels on their roofs, seven out of ten paid for them themselves and only a fifth used the 'rent-a-roof' scheme.

Reaping the benefits: A survey by market researchers Mintel found that of the homeowners who have solar panels on their roofs, seven out of ten paid for them themselves and only a fifth used the rent-a-roof scheme

Not everyone is convinced: Two fifths of those surveyed want nothing to do with the technology, Mintel found, with three out of ten concerned about maintenance costs or believing their roof was not suited

But two fifths want nothing to do with the new technology, with three out of ten believing their roof was not suited or were concerned about replacement or maintenance costs, while a quarter planned to move out before they get the financial investment back.

Only a sixth were concerned about how solar panels affecting housing prices while less than a tenth said they spent not enough time in their home during the day to benefit from the daytime electricity generated by these solar panels.

Ms Preedy added: 'Despite frequent changes in government policy and other factors, such as the strong drop in installation costs in recent years, the solar industry has proved resilient and has shown that it can reinvent itself within a changing landscape.

'The industry is expected to continue to do so in the foreseeable future, even with the uncertainties regarding future government policies.'

(Article First Published on: humanresourcesonline.net | April 01, 2015)

Want to reduce your team’s stress levels? Try giving them a seating spot with more access to natural light.

Echoing earlier reports, a new study has found employees who work in environments with natural elements such as light and green plants are more efficient and happier.

Polling 7,600 office workers from 16 countries, The Human Spaces global study highlighted staff with access to nature reported a 15% higher level of well being, are 6% more productive and 15% more creative overall.

Unfortunately however, nearly half (47%) of office employees worldwide stated they have no natural light in their working environment, and almost two thirds (58%) have no live plants in their workspace.

In Canada, 32% of workers reported having no windows. This was closely followed by Australia and the U.S., with 28% and 27% of workers respectively.

Interestingly, all three countries reported above average levels of stress.

Conversely, workers in Indonesia and India reported some of the highest levels of light and space at 93% and 92%, respectively, and reported some of the lowest levels of unhappiness.

It was, therefore, unsurprising that natural light was chosen by employees as the most wanted element in their offices. This was followed by live indoor plants, and a quiet working space.

A view of the sea and being surrounded by bright colours rounded up the top five.

“The benefit of design inspired by nature, known as biophilic design, is accumulating evidence at a rapid pace,” said organisational psychologist Professor Sir Cary Cooper, who led the study.

Indeed, office design was so important to workers that a third of global respondents stated it would unequivocally affect their decision whether or not to work somewhere.

Office design was especially vital in India (67%), Indonesia (62%) and the Philippines (60%).

Image: Shutterstock

Share the bounty! Subsidy-free! Harvest free energy and improve your lighting and ventilation by accessing our range of tried and tested and easy to install products, visit us at eco.ph

(Article First Published on: farmfutures.com | March 16, 2015)

USDA will now accept and review Rural Energy for America loan and grant applications year-round.

USDA has expanded the application and review window for Rural Energy for America grant and loan applicants, as well as provided more stable funding for the program through the 2014 Farm Bill, Ag Secretary Tom Vilsack said Tuesday.

"In the past, we've had to be concerned about appropriations processes that can change [program funding] year to year," Vilsack said, noting that the REAP funding is now tied to the life of the 2014 Farm Bill.

The REAP program offerings allow small businesses and farmers to purchase and install renewable energy systems or make energy efficiency improvements. Vilsack said this not only helps farmers and small business cut energy costs, it also cuts carbon pollution and promotes renewable energy and jobs.

"It's also a job creator," Vilsack said, noting that installers, solar panel producers and other construction employment opportunities are boosted by producers' uses of funding. More than $280 million is now available to eligible applicants through REAP.

Grants will be available for up to 25% of total project costs and loan guarantees for up to 75% of total project costs for renewable energy systems and energy efficiency improvements.

Eligible renewable energy projects must incorporate commercially available technology. This includes renewable energy from wind, solar, ocean, small hydropower, hydrogen, geothermal and renewable biomass (including anaerobic digesters). The maximum grant amount is $500,000, and the maximum loan amount is $25 million per applicant.

Energy efficiency improvement projects eligible for REAP funding include lighting, heating, cooling, ventilation, fans, automated controls and insulation upgrades that reduce energy consumption. The maximum grant amount is $250,000, and the maximum loan amount is $25 million per applicant.

Previous loan and grant recipients have used funding to build efficient greenhouses that use solar power or re-fit rural grocery stores with more efficient windows, lighting and equipment.

The REAP application window also has been expanded. USDA said it will now accept and review loan and grant applications year-round. Details on how to apply are on page 78029 of the Dec. 29, 2014, Federal Register or are available by contacting state Rural Development offices.

Additional grants for energy audits

USDA is offering a second type of grant to support organizations that help farmers, ranchers and small businesses conduct energy audits and operate renewable energy projects.

Eligible applicants include units of state, tribal or local governments; colleges, universities and other institutions of higher learning; rural electric cooperatives and public power entities, and conservation and development districts.

The maximum grant is $100,000. Applications for these particular grants have been available since Dec. 29, 2014, and are due Feb. 12.

15% of the UK’s electricity came from renewable sources in 2013, according to new analyses. Photograph: Alamy

(Article First Published on: theguardian.com | February 24, 2015)

UK is about halfway towards its commitment to meet clean energy and climate goals in 2020. Shift to more reusable energy today, visit us at www.eco.ph

The UK is on track to meet its renewable energy goals, with wind power substituting for gas and coal use and driving down greenhouse gas emissions, according to new analyses. However, the actions of the next government are likely to be crucial in deciding whether the legally binding targets can be met.

Gas use in the UK fell by more than a fifth from 2005 to 2012, as energy efficiency increased across the economy and green energy took up more of the burden.

Under European Union targets, the UK must produce 15% of its energy from renewable sources by 2020, and is one of a small number of big member states to be judged on track to meet all of its energy and climate commitments by the European environment agency.

This was confirmed on Thursday by the Office for National Statistics, which found that 15% of the UK’s electricity came from renewable sources in 2013. This puts the UK about halfway towards its commitments, because the overall energy target includes transport and heating, as well as electricity generation. For the UK to meet its EU goals, electricity generation from renewable sources is likely to have to increase to above 30% by 2020.

Gas dominates the UK’s domestic heating supply, and for most of the past two decades has been the main source of electricity generation. But this situation has reversed in the last three years, with gas use falling sharply and the slack taken up by ageing coal-fired power stations, now the biggest source of the UK’s electricity generation. This is owing to a combination of factors, including a very low price on carbon dioxide emissions under the EU’s carbon trading scheme (a high price was intended to discourage coal use) and the knock-on effects of the shale gas boom in the US, where cheap gas use has soared creating a glut of cheap coal on the international market. Gas in the UK has remained more expensive, as North Sea supplies have been rapidly depleted.

The rise in renewables while gas use fell also highlights the competition that clean energy represents to gas. Gas companies have been keen to emphasise the fuel as a “greener” alternative to coal – it burns more cleanly, producing much less carbon dioxide and none of some other pollutants associated with coal – and as a “transition” fuel that can help the move to a low-carbon economy alongside the use of renewable.

However, many in the green sector are concerned that investment in renewable alternatives could suffer if gas is prioritised. Many of Europe’s biggest players in renewable energy are power companies that still generate large amounts of their output from fossil fuels.

Renewable UK, the trade association for the wind industry, said renewable power generators were “doing their bit” towards the UK’s targets, but that fossil fuel use in transport and heating remained relatively high. For renewables to cut transport emissions too, through electric cars, the next government needs to show support for wind power, they said.

Gordon Edge, Renewable UK’s director of policy said: “Onshore and offshore wind farms have been growing rapidly and are now generating more than half of our clean electricity. The question is whether the UK will make fast enough progress on renewable heat and renewable transport as well – that’s looking less certain. If there’s a shortfall in those areas, we’ll need to generate more renewable electricity to hit the target.

“The cheapest way to do this would be to install more onshore wind, which is why it’s utterly baffling that the Conservative party is proposing to cap the development of onshore wind if they’re elected in May.”

He added that meeting the legally binding goal would require more effort: “Whichever party is in government next, it looks likely that they’ll need to consider an even more rapid scaling up in the generation of renewable electricity than currently planned over the next five years. Onshore and offshore wind are poised to step up and meet that demand but we’ll need the new government to set more ambitious targets early on, in terms of how much wind they want to see installed, or the UK will risk falling short of the overall target.”

Energy demand in Asia is rising – how to get yours for free. Visit us today at eco.ph!

(Article First Published on: eco-business.com | February 12, 2015)

Driven by rising urbanisation and a growing middle class, demand for energy in Southeast Asia is set to increase by a staggering 80 per cent between 2013 and 2035 - a rise equivalent to the current demand in Japan, estimates the International Energy Agency.

This supports a near tripling of the region’s economy, but one of the biggest challenges facing the region is balancing the need for affordable energy with curbing greenhouse gas emissions, the main cause of climate change.

Clean, renewable sources will have to become a vital part of the energy mix, even as reliance on oil imports rises across the region. Bloomberg New Energy Finance expects that US$2.5 trillion will be spent on renewable technologies in Asia Pacific by 2030 – a hole that governments alone cannot fill.

Experts say the private sector holds the key to this funding shortfall. The good news is, there already is growing interest from the private sector to invest in the region’s clean energy sector.

These include private equity funds, companies and increasingly, family offices, which are gradually taking to the concept of sustainable investing.

Sustainable investing refers to an investment approach that seeks financial return while emphasizing social good. This usually involves promoting environmental stewardship, consumer protection, human rights, and diversity, to name a few.

“Clean energy is definitely a large trend in sustainable investing and we really see that happening across the region,” says Jessica Robinson, chief executive of the Association for Sustainable & Responsible Investment in Asia (ASrIA).

In a report called “Asia Sustainable Investment Review”, published last December, ASrIA studied sustainable investment strategies and practices by investors in Asia.

“We are seeing a lot of positive trends, and one is that governments are trying to bringing in private capital to co-share not only the capital but the returns and risks,” Robinson adds.

Potential investors are now more comfortable with the risks involved in the building and running of power assets because returns have been attractive and policy support is gradually increasing albeit the level of support varies across the region.

Furthermore, an ecoystem of companies that provide services and hardware in clean energy is emerging. All these factors are contributing to the growing awareness among private investors that the clean energy industry is viable.

Nonetheless, they still need to be nudged to invest, mainly by governments, and a good way to do that is to co-share risks.

“Companies hate uncertainty… (so) this is where policy support comes in,” Robinson says.

For example, governments can back a fund specialising in clean and renewable energy and match the private-sector contributions, which Indonesia has done. They can also help with valuing projects more effectively by putting a price on carbon, she adds.

“More bankers than engineers”

In the meantime, the potential for the private sector is in Southeast Asia is huge.

“There is more money wanting to go into projects than there are projects,” says Michael Quah, professor of chemical and biomolecular engineering at the National University of Singapore (NUS).

“When you go to any conference on financing, 90 percent of them are bankers and money types. The rest are engineers,” says the professor, who is also the director of the NUS Energy Office.

Berkeley Energy, Armstrong Asset Management and Equis Funds Group are among the private groups that started investing in renewable energy projects in the region in the past decade.

U.K.’s Berkeley Energy’s Renewable Energy Asia Fund has stakes in small hydro, wind, geothermal, solar, landfill gas and biomass projects in Asian developing markets, focusing on the Philippines and India.

Armstrong’s Southeast Asia Clean Energy Fund, a private-equity fund based in Singapore, manages US$164 million of investments in utility-scale renewable energy and resource efficiency projects in Southeast Asia.

Armstrong’s chief executive officer Andrew Affleck said the fund’s early participation in the sector has generated goodwill among governments in the region.

“There are compelling reasons for private finance to invest in the renewable energy sector – and the subsequent success of companies like us should eventually encourage broader participation from large private sector institutions,” Armstrong told Eco-Business.

“New initiatives are being put in place to increase such participation,” he adds. For example, governments are reaching out to private companies to collaborate on public-private partnerships and working on increasing tax incentives for green projects. “

Singapore-based Equis Funds Group, meanwhile, invests in Soleq, a solar utility also based in the city that owns and operates 70 percent of 10 solar facilities - totalling 91MW - in Thailand.

Soleq is also financing the construction of two projects in Philippines totalling 50MW, with the rights to acquire and fund an additional 150MW of solar projects.

There are compelling reasons for private finance to invest in the renewable energy sector – and subsequent investment success of people like us should eventually encourage broader participation from large private sector institutions.

Andrew Affleck, chief executive officer, Armstrong Asset Management

A lot of work is also being done by development finance institutions such as International Finance Corporation (IFC), The Netherlands Development Finance Company (FMO), Germany Investment and Development Corporation (DEG), Proparco, The Global Energy Efficiency and Renewable Energy Fund (GEEREF), Asian Development Bank (ADB) and Obviam in the region.

They invest in private funds such as Armstrong’s as well as directly in projects, providing both debt and equity.

The name is Bond, Green Bond

While the efforts by the private sector to invest in clean energy projects have been promising, far more is needed in terms of fund-raising for projects in the region.

One innovative funding stream that could potentially make a huge difference is green bonds.

Companies that want to build, for instance, wind or solar farms, issue these bonds, which promise a certain return over the life of the project. Investors fund them by buying the bonds.

Currently, many investors are institutions such as private companies, commercial banks, insurance firms, central banks and other government bodies, asset managers, and pension funds.

For these private-sector investors, such credit-worthy fixed income opportunities may be attractive as they provide steady returns over five to 20 years.

In recent years, green bonds have raised money for clean energy, mass transit, and other low-carbon projects that help countries adapt to and mitigate climate change.

Since the first green bond was developed by the World Bank and Skandinaviska Enskilda Banken (SEB) in 2007, the global market for such bonds has grown rapidly at a compound annual rate of more than 50 percent, according to S&P Dow Jones Indices, which runs the S&P Green Bond Index consisting of 150 such issuances.

In Asia, the market is tiny but growing, says Julia Kochetygova, senior director of global equities and strategy, S&P Dow Jones Indices, in a January 2015 report “Climate Change, Green Bonds and Index Investing: The New Frontier”.

“If the current trends continue, (the global green bond market) could grow from USD$150 billion to USD$200 billion over the next three to five years, thus providing an array of investment opportunities to long-term fixed income investors,” she writes in the report.

Last July, Taiwan’s Advanced Semiconductor Engineering became the first Asian company to sell green bonds, issuing US$300 million of three-year bonds.

They received more than US$2 billion in orders, reflecting the huge demand for such products and paving the way for more companies in the region follow in its footsteps.

Institutions that are advocating green bonds include ADB’s Credit Guarantee and Investment Facility (CGIF), which provides credit guarantees to companies that want to issue local-currency bonds in Southeast Asia.

The CGIF is focusing on green bonds this year and hopes to lead the way in the development of green bond in the region, CGIF’s chief executive Kiyoshi Nishimura told Global Capital.

The agency knows there are huge green investment needs in Asean countries, especially in renewable energy and energy-efficiency areas, and there is almost no precedent for green bonds in Asia, Global Capital reported. That is why it is focusing on green bonds.

“Most likely, our initial projects for green bonds will be for renewable energy or energy efficient investments,” Nishimura says. “We are already working on transactions involving renewable energy investments in the Philippines (geothermal) and Laos (hydro) and exploring if they can be structured as green bonds.”

Overcoming Challenges

Despite the rosy outlook for green energy projects in Southeast Asia, challenges do exist, and can be as simple as the lack of communication between the public and private sectors.

“I think an issue is there’s not enough engagement between the private sector and government. So there’s a big question on where the opportunities are and where the private sector can help,” says ASrIA’s Robinson.

Affleck agrees, but adds that it’s “getting better in some countries.”

The Philippines Energy Regulatory Commission, for example, now holds timely public stakeholder consultations to address problems, he says. “And they do try to solve them.”

In addition, supply chain issues such as long waiting times for equipment and spare parts, weak support and